Tesla News [Feb 19, 2023]

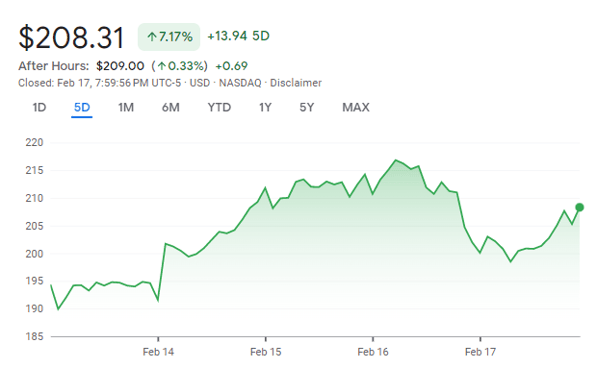

Tesla (TSLA) investors closed off the week with the stock closing +7.17% the last 5 days, which means it sits at +92.70% YTD.

Here's this week's news for Tesla, let's go through it together.

2. 360K RECALL

3. SUPERCHARGING OPEN IN US

4. GIGA SHANGHAI PAUSE

5. MIC MODEL Y PRICE HIKE

6. SIGMA LITHIUM ACQUISITION?

7. ANALYST CHANGES

LEGEND: Positive News | Neutral News | Negative News

Tesla laid off 4% of employees in Buffalo as part of a performance review program. The employees were part of the Autopilot labeling team. Tesla is facing pressures of unionization (union campaign) and some suspect Tesla made this move to curtain any potential for this to gain traction.

Tesla will be recalling 360,000 vehicles as part of a FSD issue as identified by the NHTSA.

Elon says this is likely an OTA software update fix and a "recall" is an exaggeration on the matter. Investors seemed to have shrugged off this news during the week and seemingly sided with Elon as the stock closed in the green.

According to the White House, Tesla will be opening part of its Supercharging Network to 3rd party cars. This will allow for at least 7,500 chargers available by 2024.

In exchange, it looks like Tesla will be able to take advantage of that $7.5B incentive plan the government has going - so Tesla should be able to build new stations to account for this demand increase (hopefully).

Tesla is pausing production at Giga Shanghai until March to perform factory upgrades. This will impact production numbers short term but should help increase it longer term.

Rumors are that this is to account for some changes in a newer version of the Model 3 in China.

The Made in China Model Y has seen a price hike of 2000 Yuan ($291 USD). Incremental price increase as Tesla constantly adjusts for demand.

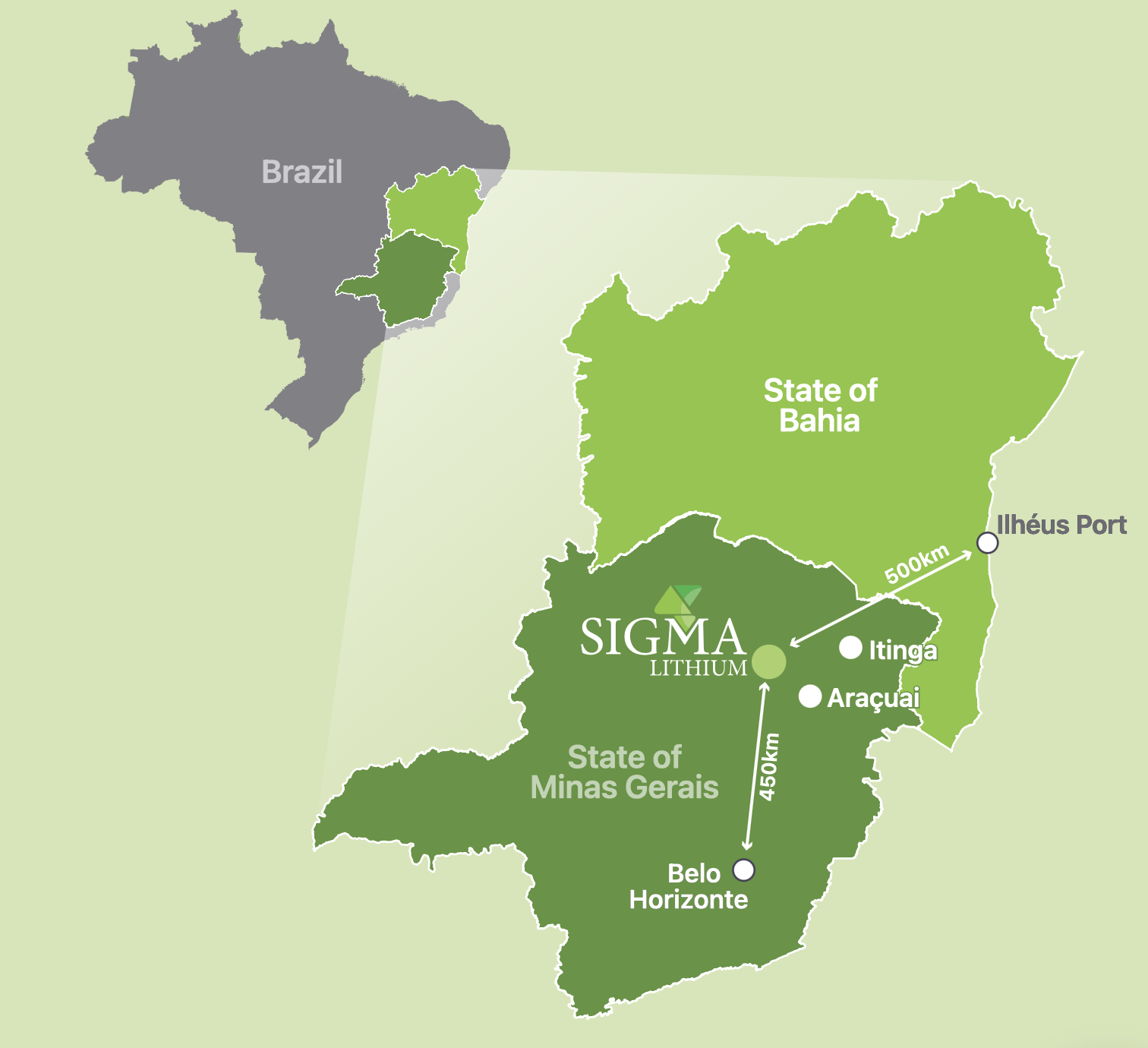

Rumors are circulating that Tesla may be getting ready for an acquisition of Sigma Lithium. The company is a Brazilian firm that does lithium mining, and the deal is expected to be around $3B.

Both parties have not commented on the rumors.

| RATING | PRICE TARGET | FIRM |

| Overweight | $275 | Barclays |

We look forward to spending a few minutes with you next Sunday for some new Tesla news!

Disclosure: I am a Tesla (TSLA) shareholder at the time of publishing.