Shopify News [Feb 19, 2023]

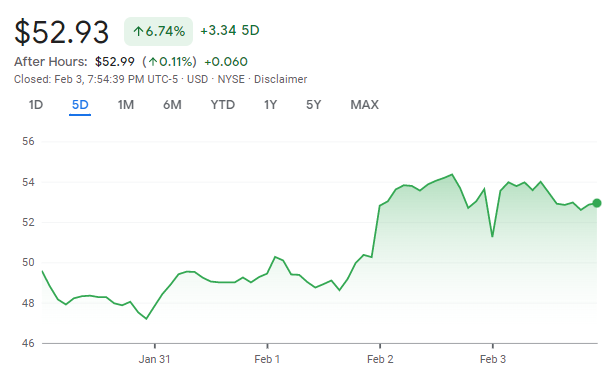

Shopify (SHOP) investors saw the stock closing -10.41% the last 5 days, which means it sits at +22.23% YTD.

Let's go through Shopify news for this week together:

LEGEND: Positive News | Neutral News | Negative News

1. EARNINGS SUMMARY

Shopify announced their Q4 2022 results. Here's the summary:

- Revenue $1.73B BEAT increased 25.4% YoY

- GAAP EPS -$0.49 MISS by $0.32

- GMV was over $60B in Q4

- Guidance revenue growth 16-19% YoY

Shopify is another growth stock that has seen big deceleration in 2022 with growth. They are expecting growth for revenue next quarter to be under 20% - which took investors by surprise.

They also touch on expenses, including SBC (stock-based compensation) and investors were overall not too pleased with how much cash the company plans to burn in 2023.

As a result the stock did see a big selloff this week but is still green YTD.

Shopify President has made it clear that they do not plan to do more layoffs.

This is great news for employees - but not so much for investors who want to see costs continue to reduce (so that Shopify can turn a GAAP profit sooner than later). The company expects to keep headcount relatively flat - so not many new hires either for the foreseeable future.

This slowdown in e-commerce is impacting all companies in this space and Shopify is not immune to this.

Rewind has announced a protection suite for Shopify merchants.

This new suite will allow merchants to protect their stores from downtime, threats, mistakes, or anything that could cause an interruption to doing business. It's a core security feature that Shopify should natively implement at some point because any downtime could be significant for merchants on their platform.

| RATING | PRICE TARGET | FIRM | |

| Neutral | $54 > $50 | Citigroup | |

| Hold | $40 > $45 | Canaccord Genuity | |

| Neutral | $36 > $40 | Goldman Sachs | |

| Outperform | $55 > $65 | RBC Capital | |

| Neutral | $34 > $40 | Credit Suisse | |

| Outperform | $45 > $65 | Oppenheimer | |

| Outperform | $45 > $55 | Baird | |

| Overweight | $46 > $56 | Wells Fargo | |

| Neutral | $36 > $45 | Piper Sandler | |

| Overweight | $45 > $55 | Keybanc | |

| Hold | $48.3 | Benchmark |

We look forward to spending a few minutes with you next Sunday for some new Shopify news!

Disclosure: I am not a Shopify (SHOP) shareholder and I am a Global-E (GLBE) shareholder at the time of publishing.